23rd February 2016 Church News.

As a first time IT Contractor you may wish to set up your own Limited Company or operate via an Umbrella Company, the choice is yours but here’s an overview around both business structures used by contractors.

You need to be aware that although the vast majority of contractors end up working through their own Limited Company due to this being the most tax efficient method, enabling them to keep more of their income, that these tax advantages are wholly dependent on whether your contracts will be caught or not by IR35, i.e. whether they fall inside or outside IR35 “rules: https://www.gov.uk/guidance/ir35-find-out-if-it-applies If you expect that most or all of your contracts will be caught by IR35 there would be very little financial justification to go Limited Company route.

*From 6th April 2016, Contractors will, as a general rule, no longer be able to claim travel and subsistence expenses through an Umbrella Company.

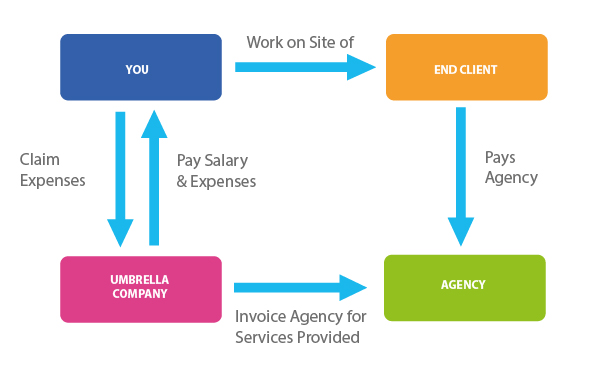

The Umbrella Company option can still have benefits for first time contractors who may not be able to, or wish to, take the role of company director or don’t want the challenge of managing their own finances and associated administration, chasing late invoices, etc. It can also be an ideal solution if you want to trial a contracting career before making a longer term commitment to contractor or if you plan to work as a contractor for only a limited period of time.

Before making a final decision, which ultimately will be determined by the needs of each individual, taking account the above points you should take advice and consult suppliers and accountants who specialise in the IT recruitment sector so that you have a fuller understanding of the options available to you and the risk and exact costs involved.

Useful Links:

https://www.professionalpassport.com/Contractors/197

https://www.gov.uk/government/organisations/companies-house